If you are one of the many people who has no idea howfill out the INFONAVIT credit registration application, you have found the right place. Inside this post, We will teach you how to carry out this procedure so that you can satisfactorily obtain your credit.

ReturnINFONAVIT AUCTION Houses

Yes indeed, before starting this process, you must be clear about type of INFONAVIT credit what do you want to get (traditional or any other product). Having said that, let's start with our explanation.

Infonavit credit application format

He Infonavit is a Mexican government institution that aims to provide housing and financing solutions to Mexican workers.

If you are interested in purchasing a house through an Infonavit loan, You must submit an Infonavit credit application. In this article, We will talk about the Infonavit credit application format, what you need to know and how to complete it.

What is an Infonavit credit application format??

An Infonavit credit application form is an official document that is used to request a home loan through Infonavit.. The form must be completed with detailed and accurate information for the credit application process to be successful..

What information is needed to complete the Infonavit credit application form??

The Infonavit credit application form requires detailed information about you and your financial situation. Next, Some of the data requested in the form are detailed.:

- Personal information: Personal information must be provided, like your full name, Social Security number, address, email and phone.

- Working Information: You must provide details about your current employment and work history, including the name of your employer, your job position and the time you have worked in the company.

- Financial information: You must provide details about your current financial situation, including your income, monthly expenses, debts and savings.

- Housing information: You must provide details about the property you wish to purchase, like the address, property value, the type of property and the estimated cost of the credit you need.

How to complete the Infonavit credit application form?

To complete the Infonavit credit application form, you must follow the following steps:

- Download the Infonavit credit application form from the official Infonavit website or request it at an Infonavit office.

- Complete all fields of the form with the requested information.

- Attach the necessary documents, as your official ID, proof of income and bank statements.

- Sign and date the form.

- Deliver the completed form and the necessary documents to an Infonavit office or send them by mail to the corresponding address.

It is important that you complete the Infonavit credit application form accurately and in detail so that your application is processed correctly..

Conclusion

The Infonavit credit application form is a crucial document that must be presented to request a home loan through Infonavit.

It must be completed with detailed and accurate information for the credit application process to be successful.. If you have any doubts or questions about how to complete the Infonavit credit application form, Do not hesitate to contact Infonavit or seek advice from a professional on the matter.

Steps to fill out Infonavit credit application

If you are looking for financing to purchase a home, and Infonavit credit may be a great option for you. However, The credit application process can seem overwhelming.

In this article, We will talk about the steps to fill out the Infonavit credit application to help you complete the process successfully..

Paso 1: Check your eligibility

Before filling out the Infonavit credit application, It is important to check if you are eligible to receive a credit. For it, It is necessary that you have contributed to the IMSS (Mexican Social Security Institute) for at least 24 continuous months. It is also important to make sure that your employer is registered with Infonavit and that you are up to date with your payments..

Paso 2: Obtain the Infonavit credit application form

The next step is to obtain the Infonavit credit application form. You can download the form from the official Infonavit website or pick it up at one of the local Infonavit offices..

Paso 3: Complete the Infonavit credit application form

Once you have the Infonavit credit application form, You must complete it with precise and detailed information. The form requires information about your work history, income, debts and other financial details. Be sure to read the instructions carefully and provide the correct information.

Paso 4: Attach the necessary documents

For your request to be processed correctly, you need to attach the necessary documents. These documents may vary depending on your personal situation, but an official ID is usually required, proof of income and bank statements.

Paso 5: Send the credit application

Infonavit Once you have completed the form and attached the necessary documents, You must send the Infonavit credit application. You can send your request by postal mail to the address that appears on the form, or deliver it to one of the local Infonavit offices.

Paso 6: Wait for the response

After sending the Infonavit credit application, You must wait to receive a response from Infonavit. Waiting time may vary, but usually it is a few weeks. If your application is approved, You will receive a prequalification letter that will allow you to continue with the process of purchasing your home.

Conclusion

The Infonavit credit application process can seem overwhelming, but if you follow the steps described above, can complete it successfully. Remember to check your eligibility, get the application form, complete it with accurate information, attach the necessary documents, send the request and wait for the response from Infonavit. If you have questions or need additional help, do not hesitate to contact Infonavit for additional advice.

Guide to complete Infonavit credit application

Complete an Infonavit credit application It can be an overwhelming process., especially if you are not sure how to do it. Fortunately, with the help of this guide, you will be able to complete your application with confidence and success. In this article, We will talk about the steps you must follow to complete an Infonavit credit application.

Paso 1: Check your eligibility

Before completing an Infonavit credit application, It is important to verify your eligibility. To receive a credit, must have contributed to the IMSS for at least 24 continuous months. Besides, Your employer must be registered with Infonavit and be up to date with your payments.

Paso 2: Gather necessary documentation

To complete your Infonavit credit application, you will need to gather certain documentation. This documentation may vary depending on your personal situation, but an official ID is usually required, proof of income and bank statements. Make sure you have this documentation on hand before you begin completing your application.

Paso 3: Download the Infonavit credit application form

The next step is to download the Infonavit credit application form. You can do it directly from the official Infonavit website. Make sure you download the most recent version of the form.

Paso 4: Read the instructions carefully

Before you start filling out the form, It is important to read the instructions carefully. Make sure you understand the instructions and questions asked on the form. If you have any question, do not hesitate to contact Infonavit for help.

Paso 5: Complete the form

Once you have read the instructions and have your documentation at hand, you can start filling out the form. Be sure to provide accurate and detailed information in all sections of the form. If there is any question that you do not understand, do not hesitate to contact Infonavit for help.

Paso 6: Review the application

Once you have completed the form, It is important to carefully review your application. Make sure all information is accurate and complete. If there are any errors or missing information, correct or add necessary information.

Paso 7: Attach the necessary documentation

Once you have reviewed your application and are sure it is accurate and complete, You must attach the necessary documentation. Make sure you include all required documents and that they are legible.

Paso 8: Submit the request

Once you have completed your application and attached the necessary documentation, you must send it to Infonavit. You can do it by mail or deliver it in person at an Infonavit office..

Paso 9: Wait for the response from Infonavit

After submitting your application, You will have to wait for Infonavit to process it. Response time may vary, but usually it is a few weeks. If your application is approved, You will receive a prequalification letter that will allow you to continue with the process of purchasing your home.

Infonavit credit application online

He INFONAVIT has made great efforts to modernize its services and allow beneficiaries to carry out various procedures online. One of the most important procedures you can carry out online is the Infonavit credit application..

In this article, We will talk about how to make an Infonavit credit application online.

Paso 1: Check your eligibility

Before applying for an Infonavit credit online, It is important to verify your eligibility. You must have an active account on the Infonavit portal and have paid contributions to the IMSS for at least 24 continuous months. Besides, Your employer must be registered with Infonavit and be up to date with your payments.

Paso 2: Access the online platform

To make an Infonavit credit application online, You must access the Infonavit online platform. For it, Log in to your account on the Infonavit portal and look for the credit applications section. If you don't have an online account yet, You must register on the Infonavit website and create your account.

Paso 3: Complete the credit application

Once you have entered the credit application section, you can begin completing the application online. Be sure to provide accurate and detailed information in all sections of the form. If there is any question that you do not understand, do not hesitate to contact Infonavit for help.

Paso 4: Attach the necessary documentation

Once you have completed the online application, You must attach the necessary documentation. Make sure you include all required documents and that they are legible. The Infonavit online platform will guide you to attach the necessary documentation.

Paso 5: Review the application

Once you have completed and attached the necessary documentation, It is important to carefully review your online application. Make sure all information is accurate and complete. If there are any errors or missing information, correct or add necessary information.

Paso 6: Submit the request

Once you have completed your application and attached the necessary documentation, You can send it online to Infonavit. The Infonavit online platform will provide you with confirmation that your application has been received.

Paso 7: Wait for the response from Infonavit

After submitting your online application, You will have to wait for Infonavit to process it. Response time may vary, but usually it is a few weeks. If your application is approved, You will receive a prequalification letter that will allow you to continue with the process of purchasing your home.

Conclusion

Applying for an Infonavit loan online is a quick and convenient process. As long as you verify your eligibility, Complete the online application accurately and attach the necessary documentation, The process can be quite simple. If you have questions or need help, Contact Infonavit for assistance.

Requirements to request an INFONAVIT credit

Requirements for Infonavit credit registration. We cannot ignore the requirements that are needed to make the formal application for an INFONAVIT credit.

So keep each of these requirements in mind before filling out the respective registration application..

- Credit request. Within this document you must fill out all the requested information in your handwriting.. That is to say, you must print it to be able to fill it out. It is important that you do not make mistakes when handwriting it..

- Birth certificate. It must be original, You can obtain it at a Civil Registry office.

- INE credential. This document is requested for almost all applications., It is used to verify your information.

- Social Security number. Obviously, if you do not have a NSS, you will not be able to aspire to an INFONAVIT credit.. In case they ask you for it sealed, you must go to a clinic.

- CURP ID. You can easily get it from the official website completely free.

- RFC Certificate. Once you have the CURP you can get your RFC from the SAT page. You just have to print it.

- AFORE account statement. You must keep the last Afore account statement, if you don't have it, Go to any Afore office to have one printed.

- Proof of address. It can be proof of any basic service, that is to say, agua, electricity or gas corresponding to the last three months.

Other additional requirements that you must meet to request an infonavit credit are:

- Be active in some job. You must be currently working to be able to apply for a loan from this institution.. You must have at least two years of seniority in the job and a cumulative 116 points.

- Workshop to know how to decide. You must attend the workshop to know how to decide because you need the certificate that they provide upon completion..

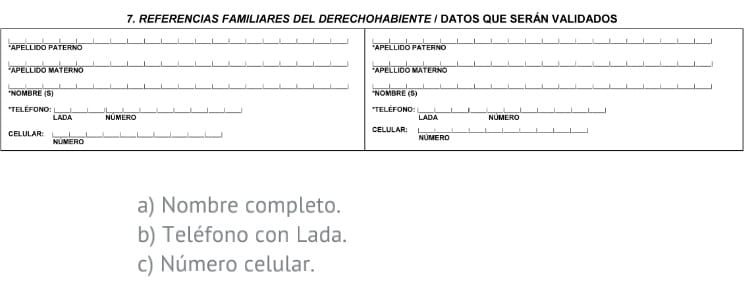

- Personal references. You need two people who know you to place them as personal references. Infonavit may possibly contact them.

How to fill out the credit registration application?

I could tell you that the first step to fill out the INFONAVIT credit registration application isfill the application. So that you fill it out correctly and without any confusion, You must pay attention to the following recommendations so that you do not make any mistakes.

- Select theINFONAVIT product What do you want to access?. If the credit is to pay a mortgage you have to register the name of the financial institution to whom the liability will be settled online 5.

- Then you must select thetype of credit.

- Now, you must select thetype of credit you are going to exercise.

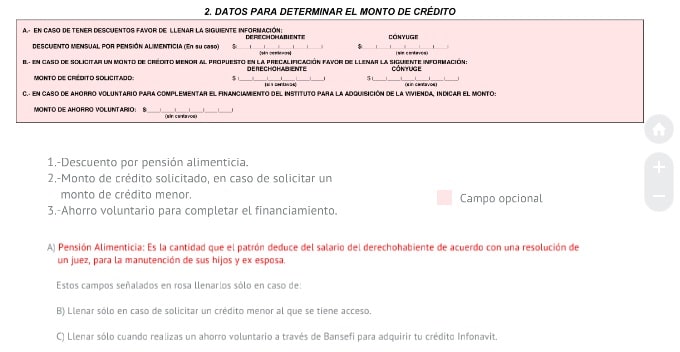

- In the next section, you must select thefactors that determine the amount of credit to request.

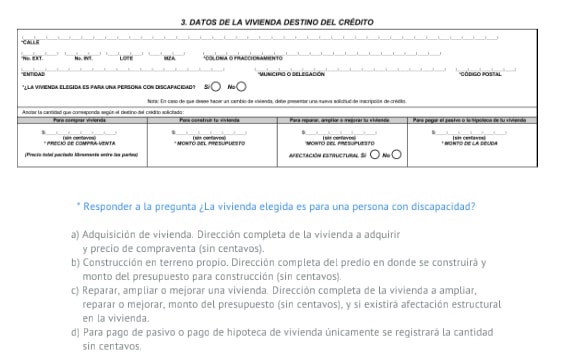

- Within the following box you mustrecord the data according to the destination of the credit.

- What follows is to register the data corresponding to the company or employer with whom the beneficiary works..

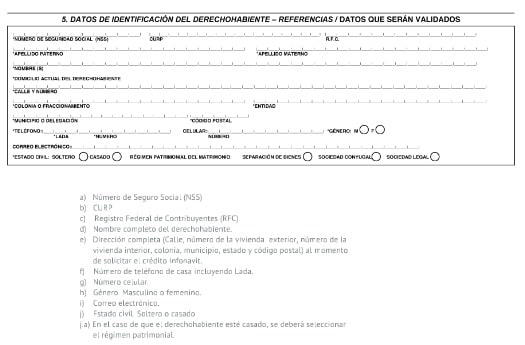

- In the next box you have to make sure to copy the data from therightful.

- Then you must register the spouse's information. Only in the event that the credit is exercised jointly.

- Within the next box, the data of the two personal or family references of the beneficiary must be placed.. These data will be verified and validated to exercise the Infonavit credit.

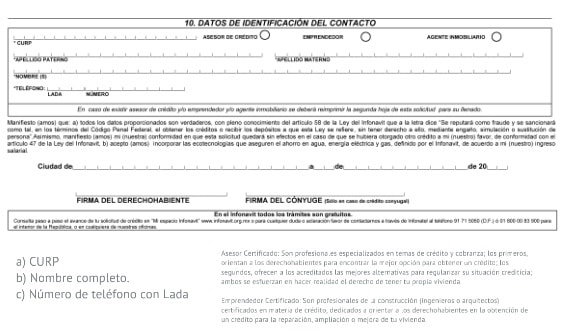

- After this, you must copy the corresponding data shown in the image below.

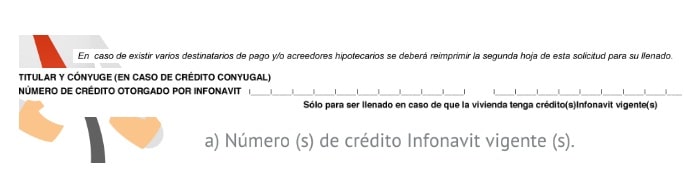

- In the event that the home is mortgaged with a financial institution. Within this box you must register the information for the deposit of the debt settlement.

- You will only fill out the following box if the beneficiary will compare the home to a person who has a current infonavit credit..

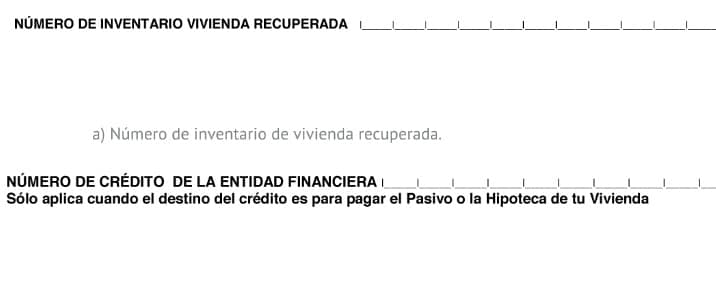

- The other two boxes must be filled out only if the beneficiary will buy a home recovered by the infonavit. Or in case you have exercised the infonavit credit for the payment of liabilities of a credit to a banking entity.

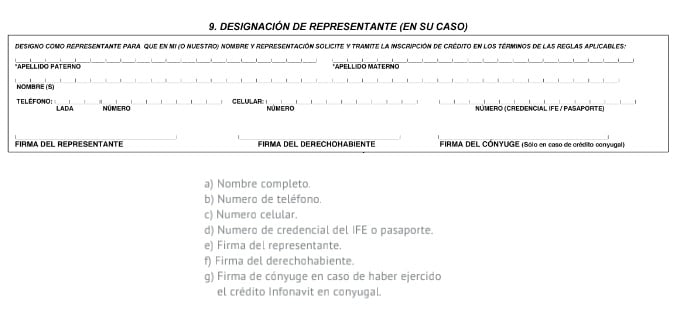

- In case you cannot personally attend to manage the credit process. You must fill out this box with the representative's information.

- If you were represented by an advisor, you must fill out this box, otherwise ignore it.

In this way you will have completed filling out the form.infonavit credit registration. Remember that you can visit theinfonavit web portal for more information.